How to file business tax extension online for free?

Step 1: Create an EZExtension account or login to your existing account

Step 2: Complete the 7004 form by inputting business and tax details.

Step 3: Download your stamped PDF as proof of extension.

If you ever had to question, where you could file business tax extension online for free, you’ve come to the right place. Use our step-by-step guide to help you file Form 7004 online free.

What Is IRS Form 7004 & Who Needs It?

Form 7004 is a form used by businesses to request an automatic extension of time to file certain business tax returns like Forms 1120, 1065, 8924, 1041, 990-C, etc.

It has to be filed by an entity that file business tax returns, such as:

- C-Corps

- S-Corps

- Partnerships

- Multi-member LLCs

- Estates & Trusts

This extension doesn’t extend the time to pay taxes due, you still need to pay your estimated tax and any other tax owed by the original due date to avoid penalties and IRS scrutiny.

If the form is filled out correctly and submitted before the original deadline, the IRS will automatically grant the extension.

Checklist – Details You’ll Need Before You Start Filing An Extension

Before you learn how to file Form 7004 electronically, you’ll need to have the following details handy:

- EIN (Employer Identification Number) and the legal business name to identify the entity

- Dates of when the tax year starts and end for your business.

- IRS return code that corresponds to the business tax form you are applying an extension for. (e.g., Use Code 25 for Form 1120-S)

- Proof of tentative tax due to indicate any taxes paid (if any)

- Officer’s name and title

How to Fill Form 7004 Free with EZ Extension

If you are not sure how to file Form 7004 for free, here is a step-by-step instruction to file through EZExtension.

An IRS-authorized filing extension platform, EZExtension, helps your business generate and file error-free Form 7004 for automatic business tax filing extensions. We are here to provide your business an IRS Form 7004 fillable PDF with built-in validation and error-checking features to guide users through the filing process.

Step 1: Sign up/Log in

Create an account on EZExtension using your email and password or log in using Single Sign-On (SSO) options like Google or Intuit for quicker access.

Step 2: Enter Business & Tax Information

Mention the legal business name exactly as registered, EIN, business address, officer’s name and title who is authorized to submit the form.

Input the tax year, mention any tentative tax due (if applicable), and select the correct IRS return code.

Step 3: Review the form

Run a comprehensive audit on your completed form using our AI-powered scan technology to flag any errors, inconsistencies, or missing fields.

Step 4: Download PDF

Download a stamped PDF version of your Form 7004 as proof of timely filing or e-file directly with the IRS (recommended for faster filing)

Inline CTA button: Generate My Free PDF

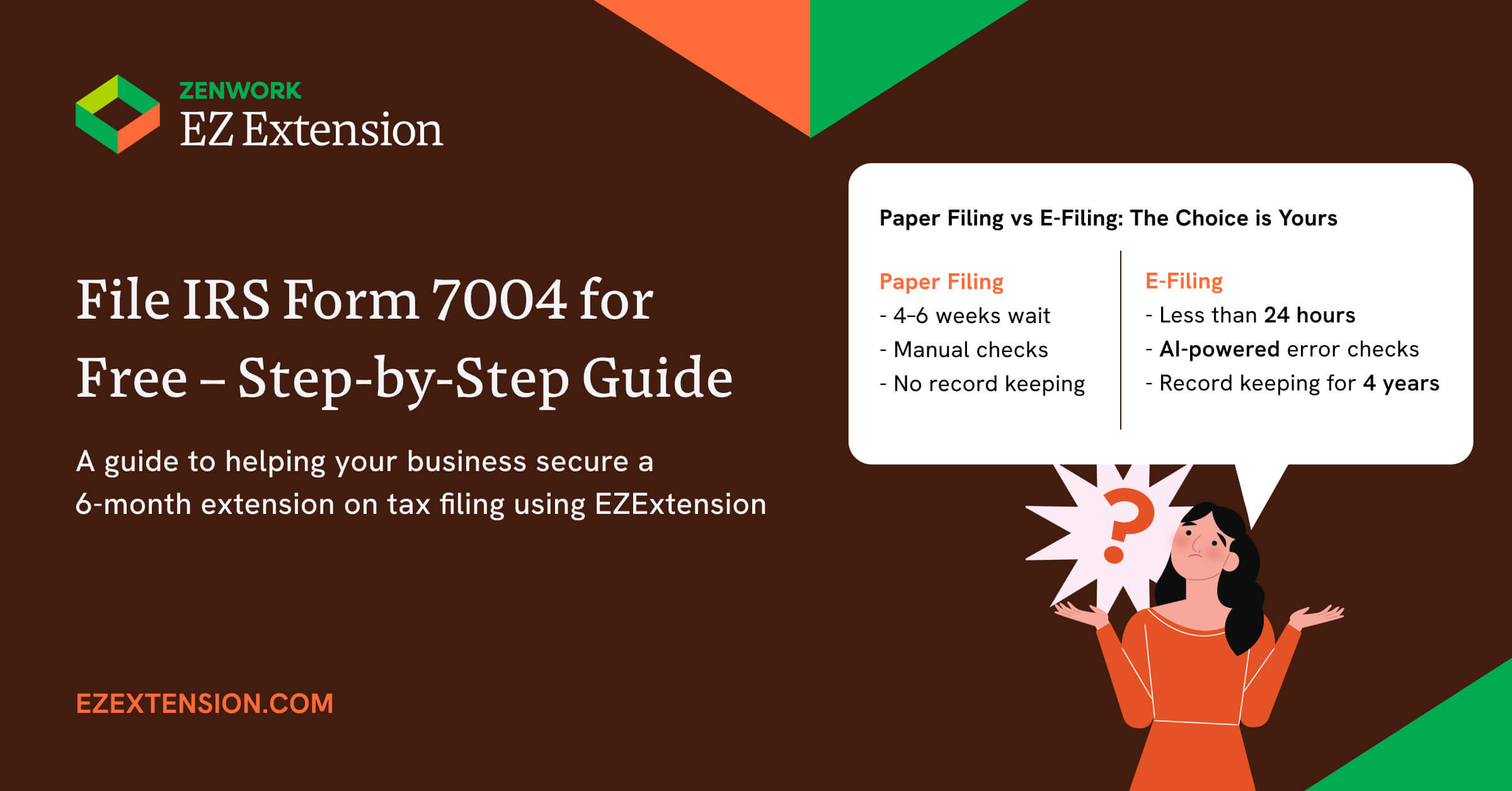

Paper vs E-file (Why Upgrade to EZExtension?)

Instead of stressing over choosing either paper filing or e-filing, we are here to make it easier for you by comparing the two methods to file business tax extension online free.

| Feature | Paper Filing | E-File with EZExtension |

|---|---|---|

| Speed | 4 to 6 weeks | Less than 24 hours |

| Proof | USPS mailing receipt | IRS-stamped PDF in inbox |

| Cost | Postage + Printing Cost | $9.99 |

| Error-Checking | None or Manual | AI-powered automatic error flagging |

IRS Deadlines & Late-Filing Penalties

Form 7004 must be filed by the original due date of the tax return for which you are filing the extension. This will automatically give you a 6-month extension to file your business tax returns.

| Business Entity Type | Original Due Date | If Form 7004 Filed (6-month extension) |

|---|---|---|

| S-Corporations | March 17, 2025 | September 17, 2025 |

| C-Corporations | April 15, 2025 | October 15, 2025 |

| Partnerships | March 17, 2025 | September 17, 2025 |

| Estates and Trusts | April 15, 2025 | October 15, 2025 |

| Tax-Exempt Organizations | May 15, 2025 | November 15, 2025 |

Where & How to Send Form 7004 (Only for Paper Filing)

If you choose to file by mail 7004 to the IRS, instead of the e-filing, you will need to find the correct mailing address for Form 7004 extension. The IRS mailing address will differ based on:

- The type of tax return you are requesting an extension for

- The state where your business or entity is located

- The total asset value at the end of the tax year

Why EZExtension Is the Best Free E-file Form 7004 Option in the Market

Free PDF generator

Get access to free IRS Form 7004 fillable PDFs where you can make unlimited edits and re-download the form as many times as needed before submission.

Guided UI

We don’t use complicated IRS jargon, instead, we offer a guided filing process with auto-selection of IRS form codes.

AI error audits

We use AI-driven validation to check your entries before submission to flag any missing details.

Multi-business dashboard

Our centralized dashboard lets you prepare, file, and track extension requests for different entities all in one place.

Free extension

Besides the free filing extension, we also offer an optional $9.99 e-file upgrade to e-file directly with the IRS.

FAQs

1.What types of forms are covered under 7004?

- Form 7004 covers most business tax returns, including:

- Form 1120 series for C-corporations

- Form 1120S for S-corporations.

- Form 1065 for partnerships and multiple-member LLCs

- Form 1041 for estates and trusts

2.Where can I get a fillable Form 7004?

You can get a fillable Form 7004 PDF for free right here on this site, EZExtension.

3.Where do I mail Form 7004?

If you choose to paper file Form 7004, you need to send the form to the state of IRS service center in your area. You can use our Mailing Address Lookup Tool to see the closest IRS center.

4.Does Form 7004 extend my payment deadline?

No, filing Form 7004 does not extend estimated tax payment deadline. You are still required to pay all your estimated taxes owed.

5.Can I e-file after I download Form 7004 PDF?

Yes, you can still e-file after you download Form 7004 PDF. All you need to do is pay the base fee $9.99 to submit the form electronically.

6.Will I get IRS confirmation?

No, the IRS has stopped sending confirmation that your extension has been approved. They will only notify you if your request was not confirmed. Filing 7004 on time gives you an automatic extension.

Get free, error-checked Form 7004 in under 3 minutes for free!